Succentrix Business Advisors Fundamentals Explained

Succentrix Business Advisors Fundamentals Explained

Blog Article

Succentrix Business Advisors - An Overview

Table of ContentsThe Ultimate Guide To Succentrix Business AdvisorsAll About Succentrix Business AdvisorsSome Ideas on Succentrix Business Advisors You Should KnowSome Known Questions About Succentrix Business Advisors.Succentrix Business Advisors Things To Know Before You Get This

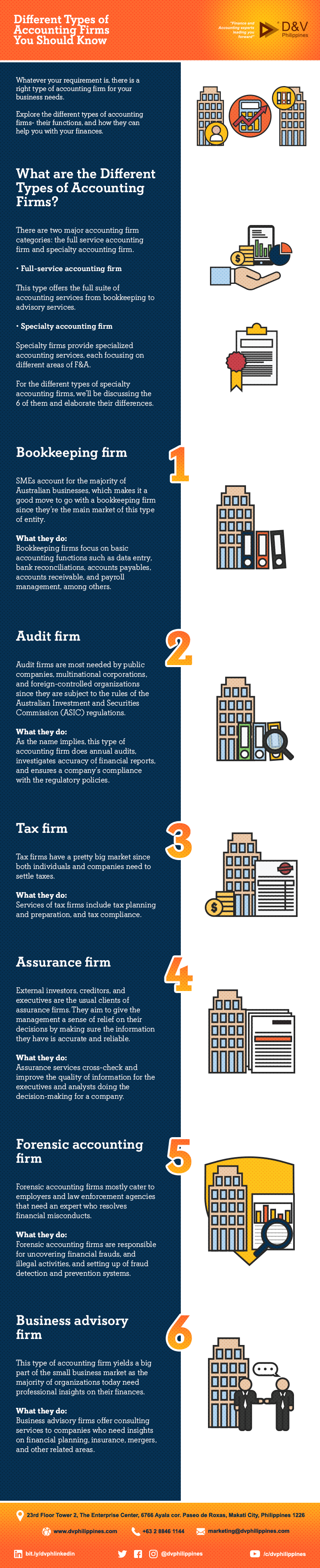

The structure and abilities of the business depend on scale and variety of services. The efficiency of work depends upon technical solutions. Specialist software program is a must. Companies utilize advanced programs to automate and simplify functioning procedures. Accountancy business aim to offer high quality solutions that help businesses and individuals handle their finances and make audio decisions about their cash.CAS firms concentrate on consultatory accounting solutions rather than a compliance-heavy service. This fad in the accounting market shifts to an emphasis on advising accountancy solutions instead than a compliance-heavy service.

Allow's obtain our acronyms straight. Now that we understand what to call it, let's find out concerning what it is! Historically, accounting businesses have actually been concentrated on the conformity side of points.

According to the & AICPA PCPS 2018 CAS Standard Survey Report, the 5 most usual client audit consultatory solutions supplied are: 1099 development and filing (91%) Monetary declaration preparation (89%) CFO/Controller Advisory services (88%) Accounts payable (86%) Sales income tax return (85%) Rather than concentrating on simply the core i.e., tax obligations, transactions, and points that have already occurred, CAS firms additionally focus on the future and attempt to help their customers remain positive and make the finest choices for their organization holistically.

The smart Trick of Succentrix Business Advisors That Nobody is Discussing

Compliance is the cake, and consultatory services are the icing on top.

CAS design, and overview specifically what services their clients will be obtaining. This allows the accountancy company to have year round money flow and obtain paid prior to the work is done.

According to the CAS Benchmark Study, CAS in bookkeeping companies are reported a median growth price of 16% over the previous year reported by the 2022 AICPA PCPS and CPA (https://www.metal-archives.com/users/succentrix).com Administration of an Audit Method (MAP) firm benchmarking research. With the benefits of using Client Advisory Solutions to both the accountancy company and the customer, it makes sense that the industry is seeing an increase in these kinds of firms

Succentrix Business Advisors Fundamentals Explained

Does your firm offer CAS? Allow us know in the remarks below. Canopy is a one-stop-shop for every one of your bookkeeping company's requirements. Subscribe complimentary to see how our full collection of services can assist you today.

Running a business involves a whole lot of accounting. Every time you videotape a deal, prepare tax obligation paperwork, or plan a cost, audit is involved.

Succentrix Business Advisors Fundamentals Explained

If you're not assuming about recordkeeping and accountancy, the chances are that your records are a mess, and you're barely scuffing by. Accounting professionals do so a lot, and they do it with knowledge and efficiency. That makes a huge distinction for a service. Certainly, accountancy is a large field, and bookkeeping services can consist of various things.

Accounting is concerning producing accurate financial records and maintaining reliable recordkeeping methods. Recordkeeping covers payment records, tax obligations, bank settlements - Professional Accounting and Tax services, basic ledger, and payroll documents based on amount of times. Bookkeepers also work to create monetary declarations for review. Every one of this drops under audit, however an accounting professional can provide a lot more monetary guidance than somebody whose function drops entirely under bookkeeping or recordkeeping.

Cpas (CPAs) are usually contacted to prepare economic statements for businesses or to aid with tax declaring at the individual or service level. Public accountants aid individuals to navigate tax obligation guidelines and income tax return, and they frequently assist organizations and people targeted by tax audits. Federal, state, and neighborhood federal government entities operate on a various scale than most organizations.

Rumored Buzz on Succentrix Business Advisors

Any kind of public entity that should follow these criteria must supply regular financial declarations and yearly records on its funds - tax advisory services. Satisfying these requirements needs specialized audit abilities. Management bookkeeping is the kind that frequently enters into play for small companies. An administration or managerial accountant will certainly aid you examine your funds, research study market conditions, and prepare for the future.

Report this page